And with higher interest rates, the VCMM’s projected 10-year U.S. stocks have increased by 1.3 percentage point since year-end 2021. Driven by lower equity valuations, the VCMM’s projected 10-year returns for U.S. Indeed, with the painful market adjustments year-to-date, the return outlook for the 60/40 portfolio has improved, not declined.

The goal of the 60/40 portfolio is to achieve long-term annualized returns of roughly 7%.But such statements ignore basic facts of investing, focus on short-term performance, and create a dangerous disincentive for investors to remain disciplined about their long-term goals.

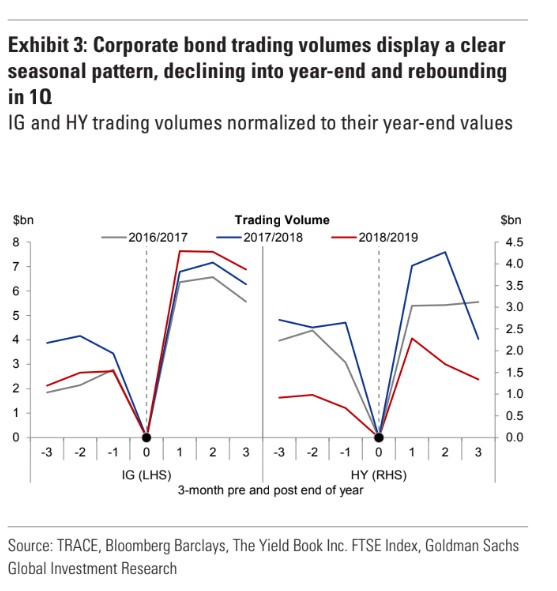

The math behind 60/40 portfoliosĬatchy phrases like the "death of 60/40" are easy to remember, don't require complex explanations, and may even seem to have a ring of truth in the difficult market environment we are in today. The one-year returns of such portfolios were negative about 14% of the time, or once every seven years or so, on average.īut we need to remind ourselves of the purpose of the traditional balanced portfolio. One-month total returns were negative one-third of the time over the last 46 years. This is due to the far-higher volatility of stocks and their greater weight in that asset mix. Over the last 46 years, investors never encountered a three-year span of losses in both asset classes.Īs our chart shows, drawdowns in 60% stock/40% bond portfolios have occurred more regularly than simultaneous declines in stocks and bonds. That's a month of joint declines every seven months or so, on average.Įxtend the time horizon, however, and joint declines have struck less frequently. stocks and investment-grade bonds have been negative nearly 15% of the time. Viewed monthly since early 1976, the nominal total returns of both U.S. Stock-bond diversification in historical contextīrief, simultaneous declines in stocks and bonds are not unusual, as our chart shows.

#Difference bond stock mix portfolio drawdown drivers

Not surprisingly, this perfect storm of negative market drivers has pushed stock and bond prices south in lockstep, impairing the normal diversification of risks in a balanced portfolio. Inflation is hitting 40-year highs, the Federal Reserve is sharply reversing monetary policy, the pandemic hasn't gone away, and supply chain woes have been exacerbated by COVID-19 lockdowns in China and Russia's invasion of Ukraine, with the latter putting the Western bloc the closest to a war footing in decades.

Based on history, balanced portfolios are apt to prove the naysayers wrong, again.Īpproaching the midpoint of 2022, market, economic, and geopolitical conditions all appear fraught. Their voices have grown louder lately, amid sharp declines in both stock and bond prices. Periodically, pundits declare the death of the 60% stock/40% bond portfolio.

0 kommentar(er)

0 kommentar(er)